Oklahoma Financial Planning

Begin the Dream Financial

Retirement is personal. You’ve worked hard to save and invest your money and now it’s time to optimize and protect your savings to provide for your retirement and your loved ones thereafter.

Begin the Dream Financial is an independent financial services firm, specializing in helping individuals and families prepare for, plan, and live in retirement. Our approach focuses on tailored retirement planning strategies and insurance solutions to provide our clients with guaranteed lifetime income, asset protection, and achieve tax efficiencies in support of a holistic approach to their finances.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

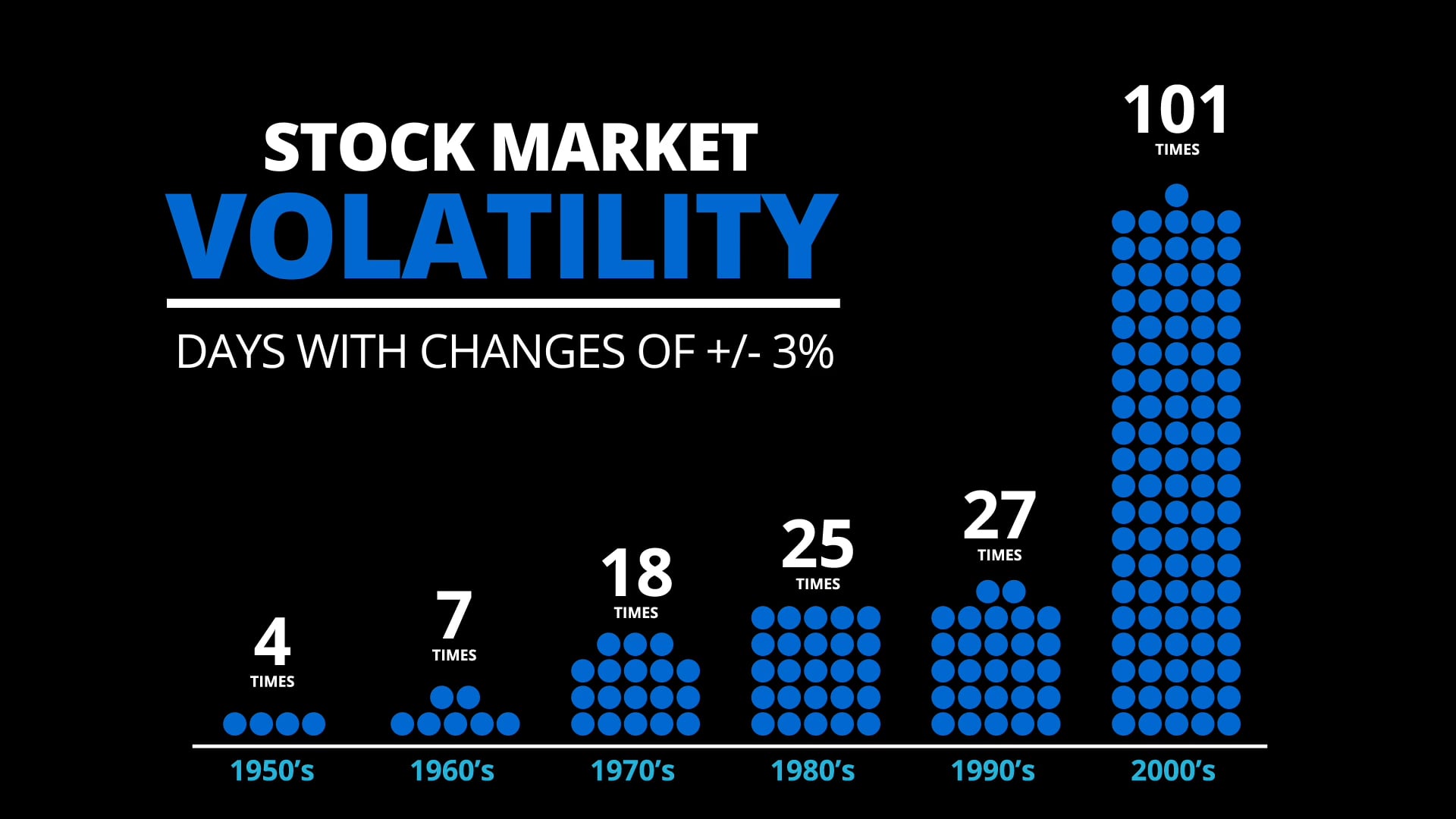

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

Our Services, Your Future

At Begin The Dream Financial, we believe true wealth starts with understanding. Our mission is to make financial literacy simple, empowering you to make confident, informed decisions that align with your goals, values, and vision for the future. Every service we offer is designed to help you build, protect, and preserve lasting financial freedom.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Wealth Architect

Bill Bennett

Founder & President

Founder of Begin The Dream Financial & White Coat Wealth Architects

Bill Bennett is a financial architect with nearly 20 years of experience helping clients design blueprints for protection, wealth, and financial independence. As the founder of Begin The Dream Financial, Bill works with high-net-worth families and business owners, providing advanced planning and legacy building strategies. Through his second firm, White Coat Wealth Architects, he specializes in guiding physicians and healthcare professionals through the unique financial challenges of their careers—from student loan strategies to tax optimization, estate planning, and wealth building.

A graduate of Oklahoma State University with dual degrees in Accounting and Finance, Bill originally began his college career as a biomedical sciences pre-med student before shifting his focus to support his family financially. That pivotal decision fueled his passion for financial education and his life mission: to empower people with knowledge so they can make confident, informed decisions about money.

Bill has spoken at teaching hospitals across the country, led financial literacy programs for medical groups, and even traveled internationally to assist with microeconomic savings initiatives in underserved communities. Known for his educator’s approach, Bill simplifies complex financial concepts into clear, actionable strategies.

Beyond his professional work, Bill is a devoted husband to his college sweetheart, Jen, and together they are raising three children. He enjoys attending his kids’ various sporting events, spending time outdoors with his family, and building meaningful, intentional relationships. Rooted in his Christian faith, Bill brings integrity, clarity, and purpose to every client relationship—helping them not just manage money, but design lives of freedom and impact.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in March–May 2026

- There are no events scheduled during these dates.